– FOR AGENT USE ONLY

Helping seniors at

Medicare training for Medicare Supplements, Medicare Advantage, prospecting, lead discounts, and more.

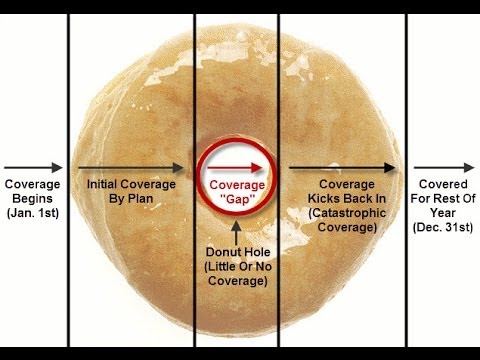

The Doughnut Hole for 2014 comes with some unrevealed parts that most seniors, and most agents for that matter, do not know about.

Most seniors believe that they enter the doughnut hole when their costs (senior's cost) reach that magic number. That is not the case.

The doughnut whole is triggered when the senior's cost + the health plan's cost for that drug, both combine to reach the trigger dollar amount, which for 2014 is $2,850. When that amount is reached by the combination of co-payments and the health insurance company's costs, the senior enters the doughnut hole and their costs soar.

Avoiding that doughbut hole, at all costs, is imperative and there is a solution you might not have considered.

Also see:

Medicare drug costs to fall in 2014, but donut hole widens

Costs in the Doughnut hole:

For 2014:

$2,850

Triggers the doughnut hole ($120 less than last year)

In the doughnut hole, seniors pay:

47.5% name brand

79% cost for generics

$4,700 = Catastrophic Coverage = co-payments then start again.

By the way, MAKE ABSOLUTELY SURE that you are shopping your Medicare

Supplement plan every single year. Rates have gone down, considerably, and

we are typically able to save folks $50 to $100 per month for the same,

exact Plan F, Plan G, or Plan N that they had with the company they’ve kept

for years.

It is critical to have your agent (or us) shop the market yearly, as all

plans are exactly the same (see Page 68 of your Medicare & You Guidebook),

but the costs are different. They can vary by thousands of dollars per year.

See: http://SeniorSavingsNetwork.org

+liem919 Some states, very few, have this information on websites within

their Department of Insurance site. This is what we do every day. As a

truly independent broker, we can look them all up, and it’s free. You can

call us at 1-800-729-9590 any time and we’d be happy to shop that for you.

It’s the same cost if you went direct or used a broker.

We, all the time, hear from seniors who were MOBBED by agents when they

were turning 65 years old, new to Medicare, and now, years later, they

cannot find that agent and their rate has gone through the roof.

A good agent should shop the market for you EVERY time there is a rate

increase.

1-800-729-9590

Is there a website to compare the monthly premiums for Med Supplement? I

currently have AARP UHC plan F, they went up about $10 more for 2014.

I would to publicly thank you Christopher for all the clear sound advice

you have shared on Youtube and the great help you have been to me in

initiating my Medicare coverage. I chose to research and purchase

personally so I could be best equipped make the right choices. You have

done a great deal to provide the information I needed. Thank you again for

your time and effort. If others ask me for someone to assist them in their

journey I will immediately suggest your services.

+stuart shaw Thank you for saying so publicly!

HAVING MEDICARE COVERAGE REALLY HELPS WITH HIGH COST MEDS. WHAT EVER PLAN

YOU HAVE YOU SAVE WITH WHAT EVER MEDICARE PLAN YOU HAVE SAVE ALOT ON YOUR

MEDS A YEAR

So, when picking up generic drugs, don’t show your card? My mom’s in the

donut hole right away for Jan/Feb. By not using her card, does that help

for next year? Or by using her card with a generic drug, it makes the hole

bigger this year?

hi Chris, I’m new to Medicare and having a hard time trying to figure out

which part D plan I should apply for. Right now I only need 2 prescriptions

a month, Proair 90 and Simvastatin 20mg so I’ve been looking at the plans

with the lowest premium without a deductible. But after listening to your

donut hole video, I’m wondering why I should even bother getting a drug

plan if I can get my prescriptions cheaper by not using my card.

+Barbnmass Why should you get a Part D drug plan? Because if you do not,

and then you need one in the future, you will first have to wait, then you

will pay 1% accumulated penalty for every month that you did not have a

plan. 60 months (5 years) means 60% higher premiums for your future Part D

plan.

Use the Prescription Plan Finder tool at http://www.Medicare.gov and see

which plan is right for you – they’re different in every county in the

country.

I am frusrated and steruggling about medicare doughnut hole. Since my pills

and insulin, inhale. Total $2,500 for 90 days x 4 times.

Chris, if you are not charging for your service and you are getting your

customers lower rates on Medigap, how are you getting paid? I don’t mean

this disrespectfully. I’m just wondering how you benefit, because it sounds

too good to be true, and you know what they say about that (:

I’m enjoying your videos very much. They are extremely informative. Thank

you.

+signmanbob And you can get an unbiased comparison at

http://SeniorSavingsNetwork.org or by calling me at 1-800-729-9590.

Information is always free! Who knows, you just might save money, too!

+signmanbob Agents are paid a commission when they sell a policy. If you’re

currently paying $180 and I can find that same, exact benefit plan with an

insurance company you did not know about and I get it for you at $100 per

month, which we do all the time, that saves you $800 per year. I get paid

around 19% commission, as every agent does, on the policy sold. I’d rather

sell plans with the the lowest premium, as all of the plan benefits on

Medigap are exactly the same.

That way, my phone rings constantly with referrals of other folks that were

sold once by an agent they never hear from again!

Chris can you sell to a Missouri resident? I will turn 65 in August and am

interested! Jay

Yes, absolutely. I have lots of happy clients in Missouri. Would be happy

to help. The great thing is that the application, when turning 65, takes

about three minutes, total.

Based on your zip code, I’ll find the very best company to go with. Call me

any time at 1-800-729-9590. Thank you – Chris

Thank you. I am a senior citizen and take several prescriptions all

generic. I did not know about this. I will check different pharmacies

prior to getting my prescriptions.

I just want to say thanks!!! It is seldom for me to get aid like you give.

I really appreciate you!!! regards ed

I became disabled about a year ago. SS just sent me a notification that

I’ve been enrolled in Medicare parts A and B. My small town doctor opted

out, if I understood her correctly, meaning I would need to choose a MAP

even to be able to benefit for my monthly checkup. I’ve been trying to read

and understand what all this means to me as far as bottom line because even

without part B being drawn from my disability, I am barely surviving. My

monthly out of pocket cash to my doctor is $70. My monthly Rx costs are

about $150. Unless I am missing something, it seems to me that I am better

off without part B or a MAP with D (prescription coverage). What do you

think?

+Don Fuller that all depends on your age and your location.Plan

availability is based on your zip code, and plans vary greatly.Happy to

help with an opinion, if you’ll call our office at 1-800-729-9590.

I’m a new retire from IBM and am totally lost in all this medicare bs. I’ve

been on numerous meds for some serious conditions. I reached this donut

hole after only having 4 prescriptions filled. Needless to say, I’ve had to

stop taking most of these meds because of the high price. I feel like I’ve

been tossed to the sharks. At our age, with the obvious lack of health,

affording our prescriptions and seeing our doctors is more important than

ever. Now we’re being told to play let’s make a deal with everyone

pertaining to our medical in order to avoid this donut hole. This is

insane. The insurance company that was chosen for me by IBMs elected go for

team has turned into a nightmare and steadfastly refuses to give an inch.

If these are medicare supplement insurances, I’s like to know what the heck

part of medicare they supplement because I’m not seeing it. Even when I was

younger and working I wouldn’t have been up to all this work that being

expected of seniors. We get pushed around at every turn, and worse, where

we become an out an out annoyance to everyone involved. And how many

seniors have this $4500.00 to shell out once they hit this donut hole?

We’re talking about rcvg perhaps a 1% increase in social security, while

prices sky rocket in all areas. We’re already forced into making tough

choices about cutting back our food intake, turning the home temp to an

uncomfortable low, and using the car only when absolutely neccessary. And

now, our companies are dumping us from their insurance plans… I mean,

this is out and out wrong. Food stamp ppl have got it made. Their allowance

is at an all time high. Medicaid ppl don’t have to worry. Young ppl who are

employed don’t have to worry. But you take aging Americans, and it’s like

“What? We can’t hear you. What? There’s nothing we can do. What? Oh go get

lost for pete’s sake.”

Thanks for the video and info. I just got my card in the mail and my

coverage starts Feb. 1st. 2015. Trying to get get myself up to speed and

educated on this new world of health care i have entered into. The donut

hole sounds more like a black hole.. Now i have to go and search for who

created the donut hole and why? Just for the sake of knowing! And who

benefits the most from the creation of the donut hole? Again thanks…

We are on Plan F not Medicare Advantage. Does this donut hole information

apply to us?

Plan F is the coverage for Part A and B (“Major Medical”) and has nothing

to do with the prescription drug plan. Regardless of what prescription plan

you have, you cannot change it now, anyway, and hopefully your agent went

over all of the options with you during the Oct. 15 – Dec 7 annual election

period.

If you have not reviewed the lowest rate on your Plan F in the last 6

months, I HIGHLY recommend you call our office so we can shop that for you.

For the same, exact benefit (Plan F) we often save folks from $50 to $100

per month.

Your doctor, hospital choices, etc. etc.. all stay the same, but as an

independent Medicare Supplement broker, we shop for you, not the insurance

company.

Great information that everyone on Medicare or an Advantage Plan must know

about! You are spot on! I caught this on a few of my scripts last year!

thanks for the info, this came in handy in my billing class.

very useful info

Do you have any idea of the probability that one would have to pay excess

charges to a doctor? Do most doctors accept assignment?

Thanks Chris, I just started with United Health Group and needed this info

for presentations.