Medicare Advantage is an insurance program that invites private payors, including health plans and insurance companies, to offer alternatives to traditional Medicare. By providing access to the private insurance market, Medicare Advantage gives beneficiaries the option to choose from a wide range of competing plans, many of which offer richer benefits than Medicare. This video explains how Medicare Advantage works.

Video transcript

Medicare Advantage is part of the U.S. Medicare system, which is a federal health insurance program that covers 50 million elderly and disabled Americans.

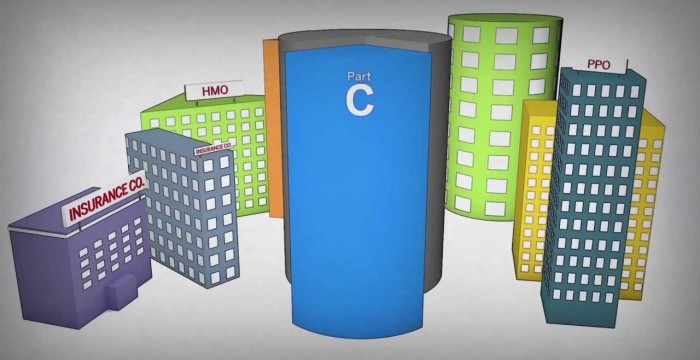

Medicare Advantage, also known as Medicare Part C, differs from traditional Medicare in that it doesn't define categories of health coverage in the same way as Medicare parts A, B, and D.

Instead, it's a special program that invites private payors, including health plans and insurance companies, to provide alternatives to traditional Medicare insurance.

As with traditional Medicare, eligibility for Medicare Advantage includes most U.S. residents over age 65, as well as certain nonelderly people with disabilities.

While traditional Medicare is administered directly by the federal government, under Medicare Advantage, the government contracts with private payors. At minimum, these payors are required to provide the same level of coverage outlined in Medicare Parts A and B, and typically they provide Medicare Part D prescription drug coverage, as well.

By providing access to the private insurance market, Medicare Advantage gives beneficiaries the option to choose from a wide range of competing plans, many of which offer richer benefits.

A growing number of Medicare beneficiaries are opting for Medicare Advantage. Twenty-seven percent are currently covered by Advantage plans, and enrollment is expected to continue to increase in 2013.

All Medicare Advantage plans are funded by federal Medicare dollars—but some plans require members to pay an additional premium.

The premium is determined by the benefits provided and the federal reimbursements in the area where the plan is offered.

Medicare has specific rules for how Advantage plans are priced. Each county has its own payment benchmarks, as well as different benefit and premium combinations.

Each spring and summer, Medicare Advantage plans participate in a bid process that establishes the terms of contract between the payor and the federal government for the next calendar year.

Before bids are submitted, plans project member health statuses, costs, revenue from the federal government, and member premium. These projections serve as the basis for the bids, which define the benefits to be offered in each plan.

Once the bid process is complete, members are told what the premiums and benefits will be for each plan in the coming year.

During the eight week open-enrollment period for Medicare Advantage, beneficiaries must consider a number of variables to decide on a plan that best suits their healthcare needs and budget.

In addition to monthly premiums, benefit options, and out-of-pocket limits, they must also consider network composition and plan type.

If provider choice is important to them, they may opt for a plan that features either a Preferred Provider Organization (PPO) or Private Fee-for-Service (PFFS) structure rather than a more restrictive HMO.

Beneficiaries will also want to consider how flexible a plan is with respect to authorizing prescriptions. While most plans provide for prescription drug coverage, not all of them will pay for all pharmaceuticals. Within each class of drugs, plans may cover only a limited number of drugs.

Ultimately, those looking for more comprehensive benefits may gravitate toward the Medicare Advantage program.

For more on Medicare, and healthcare in general, visit our blog: www.healthcaretownhall.com

RELATED MILLIMAN SERVICE

Medicare Advantage (Part C) consulting