In this video I'm going to give you a really quick and simple overview to help get you started with understanding your Medicare plan options.

First of all, as you probably already know you can enroll up to 3 months before your 65th birthday. So to avoid having your benefits delayed you will want to at least make sure you enroll before the month of your birthday.

Also, every year from October 15th to December 7th there is an open enrollment period where you can change plans. However, your first year is going to be the most important, because its only in the first year that you can't be excluded for any pre-existing conditions.

Ok. So lets review the different parts of Medicare…

Medicare Part A is for your hospitalization and everyone gets this as long as you've accumulated 40 credits of work history. There is no cost for this.

Part B Is for your regular medical costs like doctors visits etc. In 2013 The cost for Medicare part B starts at $104.90 and goes up a little depending on your income. So if you made $90,000, for example, your cost would be $146.90/mo. Most people just have this deducted right from their Social Security Check.

Pretty straightforward so far. Here is where some of your choices come in.

Your first choice is to choose between "Original Medicare" (Parts A & B) which we just discussed, or you can choose Medicare Part C (a Medicare Advantage Plan).

A medicare advantage plan is required to offer at least the same level of coverage as medicare. Many providers offer benefits packages that cover medical expenses not usually covered by medicare, like vision, and hearing coverage, even gym memberships in some cases.

One primary disadvantage of Medicare advantage plans is that they are usually set up as a local network. So if you travel outside the network you may not be able to find medical services that are covered under your plan.

After deciding on, Original Medicare, or a Medicare Advantage Plan, your second choice is to decide if you need Medicare Part D, for Prescription Drug Coverage or not.

Medicare Part D is offered through private insurance companies and will cost approximately $40- $45 per month depending on which provider you choose. Cost is not the only factor to consider when choosing a part D insurance company. Each company could have different rules, on they treat different medications you may be taking. So be sure you explore each company thoroughly.

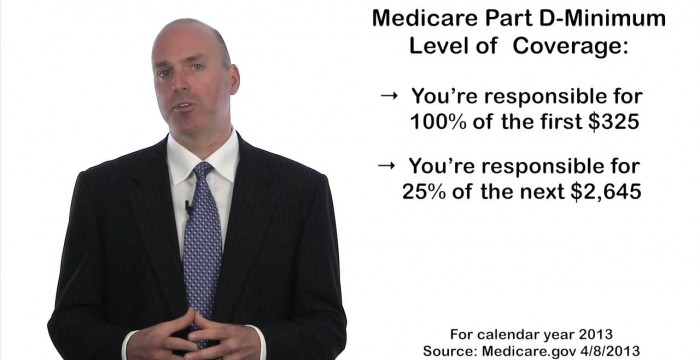

Although each company may classify certain drugs differently, they all must offer at least a minimum level of coverage.

With the minimum level of coverage…

You are responsible for the first 100% of $325 of prescription expenses out of your own pocket.

Then you will pay 25% of the next $2645. So your exposure would be $661.25.

Then you are responsible for 100% of the next $3763.75. This is often called the donut hole. As you can see, it's very expensive.

Up to this point, you would have paid a total of $4750 out of your own pocket, for $6,954.52 in total drug costs.

After that, the plan kicks in again and now you are responsible for just 5% of your prescriptions or a minimum copay of $2.65 for generic drugs and $6.60 for name brand, whichever is greater.

Lastly, if you decide to go with Original Medicare, you will also need to decide if you need to add on a Medicare Supplement Plan. Because your out of pocket prescription costs can be so high, your Medicare supplement plan will not only help pay for some of your prescription expenses that aren't covered, but also pay for some of your other medical expenses not covered by medicare part B. The cost for a medicare supplement plan can vary from company to company and are dependent on the level of coverage you elect, but typically you can get a pretty good policy for around $150/month.