This week we’re starting things off with Annamarie in Pennsylvania, who at 63, is planning on retiring in the next few years. She was recently approached by her financial advisor about placing her current 401(k) into an annuity. Good idea or bad?

Next up was Susan from Tennessee who is trying to navigate things after the unexpected passing of her sister. Named as executor of the will, Susan understandably has a lot of questions.

In hour two we brought back Steve Vernon, an old pal of mine from my CBS MoneyWatch days.

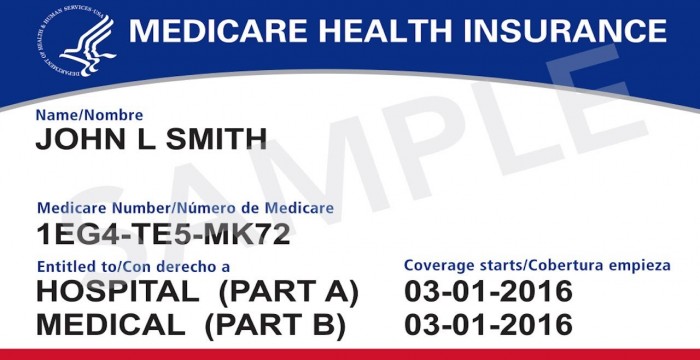

Steve joined us to talk about Medicare open enrollment as well as answer some of your Social Security questions.

With Medicare's open enrollment period running through December 7, you have a golden opportunity to make changes that might better serve you in the years to come.

Many people assume that because Medicare is called "medical insurance," it's similar to their employer's medical insurance that protected them during their working years. But that's wrong.

Employer-sponsored health care plans typically have one set of deductibles and copayments, and you only need to pay one premium to obtain comprehensive coverage. Not so with Medicare – it's much more complicated than that. Traditional Medicare has three different parts that cover hospital, outpatient, and prescription drugs – called Parts A, B, and D, respectively. Each part has its own set of premiums, deductibles and copayments.

As a result of having these three different parts, many retirees mistakenly assume hat Medicare provides all the coverage they need. Or they think they're healthy and won't need additional insurance coverage beyond Medicare. Then they're shocked when they experience their first significant medical claim and are forced to pay thousands of dollars out-of-pocket.

You can guard against these surprises by purchasing either a Medicare Supplement Plan (aka Medigap) or Medicare Advantage Plan. These plans are both designed to reduce Medicare's significant gaps. By one estimate, millions of retirees make the mistake of not purchasing such a plan to help close Medicare's gaps.

Have a money question? Go to jillonmoney.com for all the contact info.

We love feedback so please subscribe and leave us a rating or review in Apple Podcasts!

Connect with me at these places for all my content:

"Better Off" theme music is by Joel Goodman, www.joelgoodman.com.