Increasing FICA Taxes

And we've already begun to see the squeeze that the long-living baby boomers will place on Social Security. Social Security taxes already have increased, and benefits already have been cut.

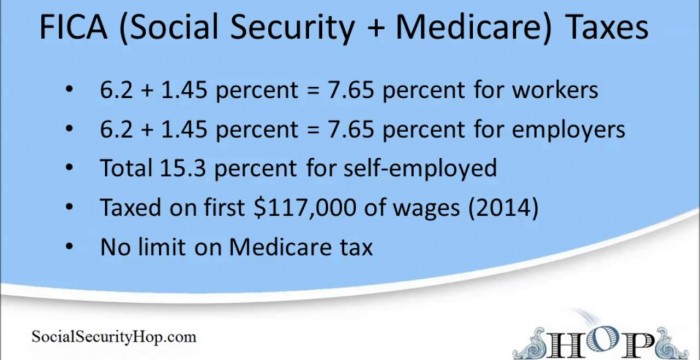

Social Security taxes, known as payroll or FICA taxes, increased from less than 6 percent in 1976 to 7.65 percent in 1990. This rate is levied on both employees and employers so the total FICA tax is now over 15 percent of your salary.

Also, the taxable wage base grew dramatically over this time. In 1976 you paid FICA taxes on only the first $17,000 in wages. Now you pay taxes on your first $62,000 in wages.

By the way FICA stands for Federal Insurance Contributions Act. But make no mistake. These are taxes, not contributions.

If you decide not to contribute this year, you'll be getting a telephone call. The IRS almost ruthlessly pursues those who don't pay their payroll taxes.

FICA taxes are also hard to avoid. There are no exemption levels as there are with income taxes. You pay FICA taxes on your first dollar of wages. Although you can defer income taxes via retirement accounts, you can't avoid paying FICA taxes, so FICA taxes hit low-income people especially hard.

Copyright 1997 by David Luhman

Fico taxes hit low income people hard that’s just simply another way for the government to get into the little guys hard earned money, why pick on low income people the hardest why not pick on these rich pricks who make millions just for saying one damn word in a commercial, USA government is meant to cripple the already crippled folks, government is here to keep the low income people in poverty and take all there money and make it so that they cannot afford nothing, WTF